Startup India initiative was launched on January 16, 2016, by the government of India. The objective was to support entrepreneurs and build a strong ecosystem for promoting innovation. They also intended to create a vigorous startup ecosystem as well as shift India towards creating jobs rather than seeking them. It has turned out to be an effective scheme by rolling out different programs to support entrepreneurs in India. These programs are handled by a committed Startup India team, which reports directly to the Department for Industrial Policy and Promotion (DIPP). To promote the entrepreneurs, different benefits are provided to the startups.

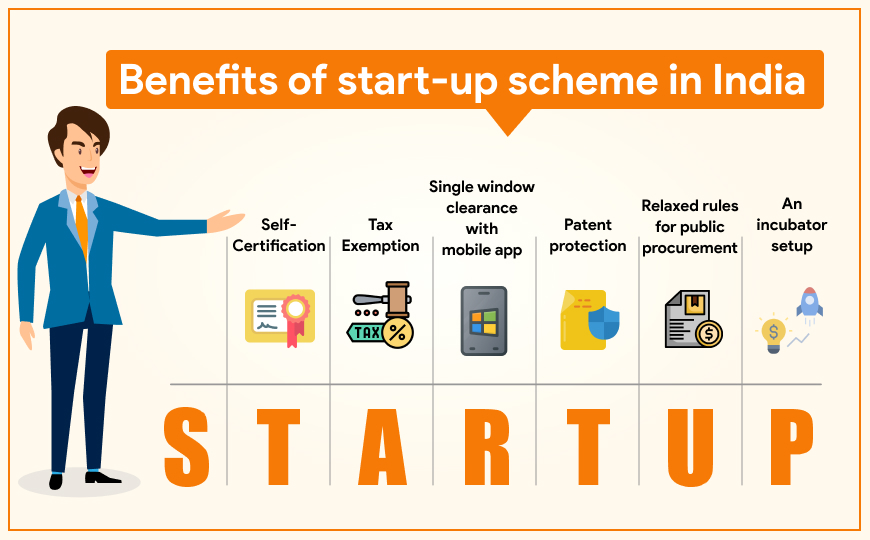

- Startups can easily self-certify their compliance under six labor laws and three environment laws. This is allowed for 05 years from the date of registration of the company.

- The profits that are earned by the startups having been granted inter-ministerial board certificates are exempted from income tax for three consecutive years.

- Startups also known as fast track firms can be wound up within 90 days as against 80 days for other companies. Moreover, an insolvency professional is required for liquidating the assets and paying creditors.

- Startup India provides quality intellectual property services and resources to help startups protect and commercialize their IPRs. This includes:

- To meet the quality and technical specifications, all the government of India departments, ministries, and PSUs have been provided authority to ease the norms. Thus, a startup can gain exemptions on:

- Startup India advocates innovation as well as research among those who are projecting themselves as entrepreneurs in the upcoming time. The government is taking all the measures to support the entrepreneurs. The government is looking forward to establishing seven new research parks for the research and development of the products.

Your startup needs to be a private limited company or a limited liability partnership.

It should be a new firm. It should not be older than five years and the total turnover should not cross 25 crores.

The companies must have approval from the Department of Industrial Policy and Promotion (DIPP).

The form should have obtained a patron guarantee from the Indian Patent and Trademark Office.

The company must have a recommendation letter from an incubation.

The firm must offer innovative schemes or products.

The company is working towards innovation, development, or enhancement of products or services or the company should have a scalable business model with an objective of employment generation or wealth creation.

To conclude, this startup scheme is very beneficial to start the new ventures and even for the expansion of newly setup businesses. So to start you only need to contact Credence Corporate Solutions for all startup solutions may it be accounting, business taxation or business registrations.

© 2020 CREDENCE CORPORATE SOLUTIONS PVT. LTD. | Website by Wits Digtal Pvt. Ltd.

Leave a Comment