CONNECT TO AN EXPERT

TDS tracing facilitates the connection of all stakeholders engaged in the implementation and administration of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS). TDS TRACES helps in viewing and downloading crucial tax documents such as Forms 26AS, 16A, and 16. The TDS TRACES makes it possible to carry out tax-related activities with ease.

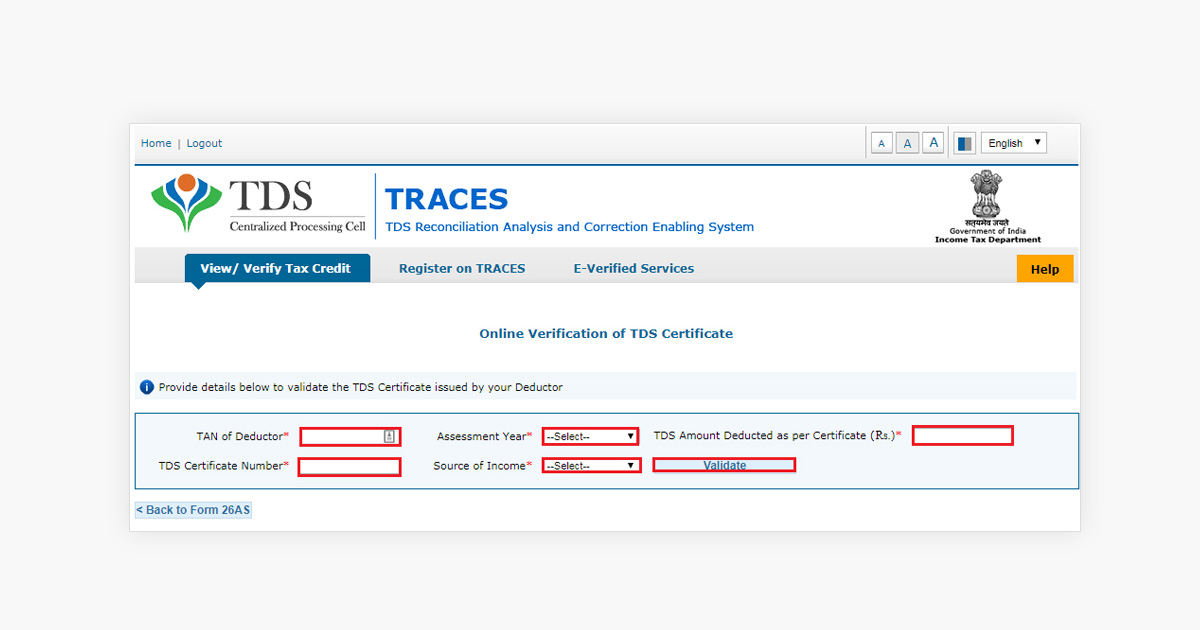

TDS Reconciliation Analysis and Correction Enabling System (TRACES) is an Income Tax Department web platform that enables taxpayers to view their TDS payments online to file returns and seek refunds. Taxpayers and deductors can use the TRACES website to view TDS and TCS paid to double-check the details when submitting returns and claiming refunds. TRACES enhance the interaction between the tax deductor, deductee, and income tax department. Tax deductors/collectors, taxpayers, and Pay Account Office use TRACES.

What is TDS?

TDS stands for Tax Deducted at Source. It refers to the amount deducted by a person who is committed to paying another person a specified amount of money, such as a salary, rent, fees, commission, interest, and so on. The deductor remits the TDS so deducted to the Central Government.

What is TCS?

TCS or Tax Collected at Source, is a tax that a seller collects from a customer at the time of sale of goods or products. The vendor deposits the TCS collected into the government account. TCS is levied on goods of a commercial or trading character.

Benefits of TRACES

The goal of TRACES is to allow both TDS payers and deductors to view and reconcile their TDS payments online to file returns and seek refunds. This platform gives the following benefits to taxpayers:

Offices in India

Years Experience

Your Time

Back Guarantee

Credence Corporate Solutions Pvt Ltd is one of the leading Online Business Solution Company in India, where any Large, Medium or Small business houses as also Entrepreneurs get Start-up services and Taxation solutions. One stop business set-up and corporate services company. We are a team of Professionals and Associates like Chartered Accountants, Company Secretary and Consultants with vast knowledge and experience, committed to provide consistent, customized and workable solutions in the fields of ROC, Taxation, Accounting, Labour Laws, Audits, etc...

Read MoreGet the latest company news, corporate information, and more on Credence Corporate Solutions. View this section for the recent information on Company Registration, Licenses, GST, Income Tax, Trademark, Product Mark and other topics. Get to chat with our business experts, read business articles, and stay up-to-date on the newest business news.

Feb 16, 2026

Feb 16, 2026

Companies Act, Section 437: Appeal and Revision Against Orders of Special Courts Section 437 of the Companies Act, 2013 outlines the appellate and revisional jurisdict...

Read More Feb 16, 2026

Feb 16, 2026

Companies Act, Section 436: Offences Triable Only by Special Courts Section 436 of the Companies Act, 2013 specifies that certain offences committed under the Act will...

Read More© 2020 CREDENCE CORPORATE SOLUTIONS PVT. LTD. | Website by Wits Digtal Pvt. Ltd.